.webp)

Running a growing business means dealing with a lot of transactions every month. Salaries, sales, expenses, bank transfers, and taxes all occur simultaneously. So how do you keep your accounts organized and ready for audits?

The answer is a proper Chart of Accounts (CoA).

A Chart of Accounts is the backbone of your business finances. It organizes every transaction into Assets, Liabilities, Income, Expenses, and Equity. This makes it easier to track what’s coming in, what’s going out, and how your business is performing.

In Bangladesh, a clear Chart of Accounts is even more important. It helps with accurate VAT payment under NBR rules, keeps audit records transparent, and brings consistency across all branches and departments.

That’s where Biznify helps. It comes with ready VAT-mapped templates and a clean interface to add, edit, and manage every account category in one place.

Whether you run a small company or a large enterprise, Biznify keeps your Chart of Accounts simple, organized, and always ready for reporting.

A Chart of Accounts (CoA) is a structured list of all the accounts your business uses to record financial activities. Think of it as the master list that keeps your accounting system clean and consistent.

Every sale, expense, or payment your business makes is stored under the right category, like Assets, Liabilities, Income, or Expenses. This helps you understand exactly where your money is coming from and where it’s going.

Here’s a simple example:

| Transaction | Debit | Credit |

| Product sales worth Tk 10,000 | Cash (1010) | Sales (4000) |

This small entry shows how both your cash balance and sales income are updated automatically in your books.

A well-structured Chart of Accounts connects directly to journals, ledgers, and financial reports. That means every invoice, salary, or tax payment instantly appears in the right place without manual tracking.

In Bangladesh, this structure is even more valuable. Businesses must prepare VAT-compliant returns, meet NBR audit standards, and manage multiple branches. A digital CoA inside Biznify ERP solution solves all of that by automatically linking account types with VAT categories and calculation.

Biznify’s default setup includes:

Assets: Cash, Bank, Inventory

Liabilities: Accounts Payable, VAT Payable

Income: Product Sales, Service Income

Expenses: Rent, Payroll, Utilities

Equity: Owner’s Capital, Retained Earnings

With this structure, your accounting stays accurate, compliant, and ready for quick financial reporting.

Many Bangladeshi companies set up their Chart of Accounts once and never look back. Over time, this creates messy records and reporting gaps. Here are some common mistakes to avoid:

1. Too many duplicate accounts

When multiple team members add similar accounts for rent, salary, or sales, reports become confusing and inconsistent.

2. Using vague account names

Accounts like “Miscellaneous Expense” or “General Income” make it hard to track where money really goes.

3. Ignoring VAT mapping

If your CoA isn’t linked to the right VAT categories, your NBR submissions can become a headache.

4. Mixing personal and business transactions

This happens often with small business owners. It leads to wrong profit figures and audit risks.

5. Not reviewing accounts regularly

Businesses grow and change, so your CoA should too. Reviewing it every quarter keeps reports clean and relevant.

Biznify helps prevent these issues with built-in validation rules, VAT-ready templates, and branch-wise account grouping. So your financial data always stays accurate and organized.

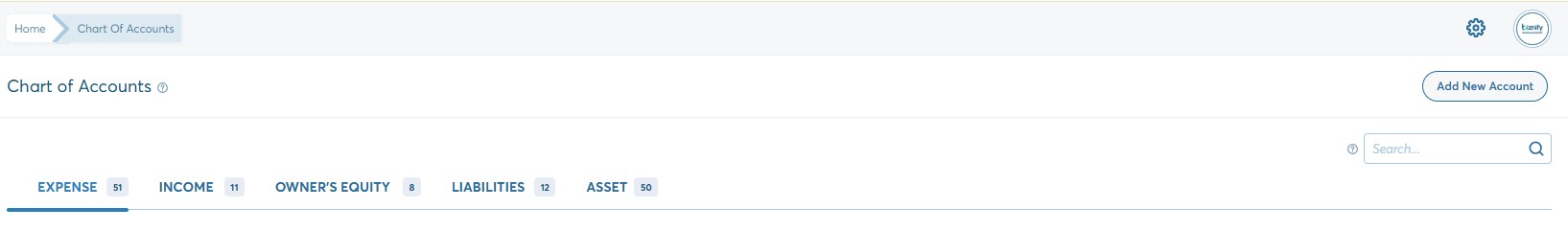

Setting up a proper Chart of Accounts can sound technical, but with Biznify, it’s easy and fast. The system guides you step-by-step so every account sits under the right category and connects automatically with reports.

Here’s how it works:

Start with ready templates – Choose a pre-built structure made for Bangladeshi businesses, already mapped with NBR VAT codes.

Add or edit accounts – Create new ones as needed (like “Marketing Expense” or “Sales Commission”) and assign them to the right type.

Set up approval roles – Control who can add, edit, or delete accounts for better accuracy.

Link to other modules – Your CoA connects directly to Sales, HR, and Inventory modules, so every transaction is tracked in real time.

Review your reports – Get instant trial balances, balance sheets, and expense summaries without exporting to Excel.

This process keeps your accounting structured from day one. Whether you’re managing one office or five branches, Biznify keeps your chart of accounts unified and audit-ready.

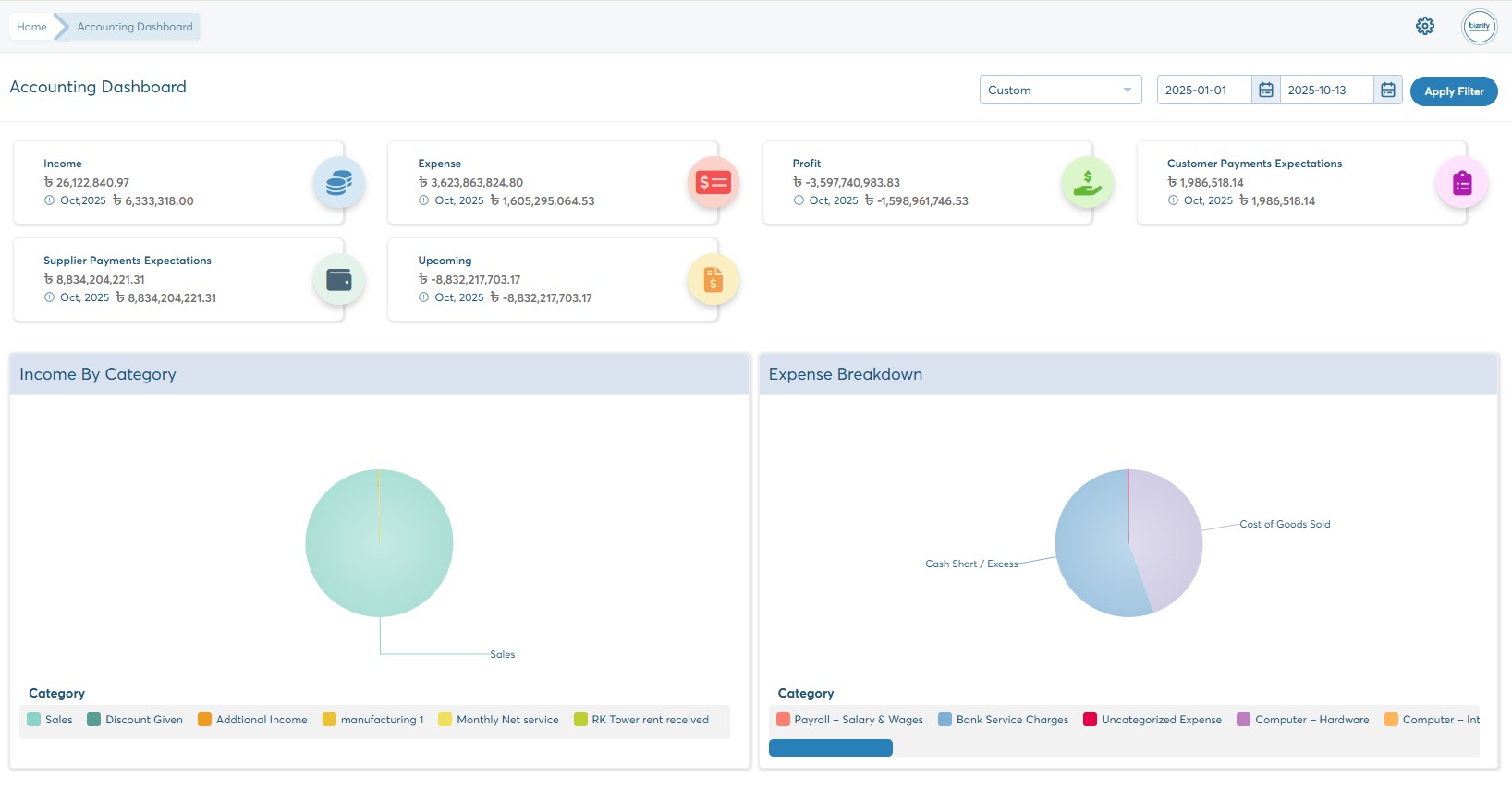

A clear, well-structured Chart of Accounts (CoA) doesn’t just make bookkeeping easier; it changes how you understand your business. When every account is mapped correctly, your reports start to make real sense. You can instantly see:

Which products earn the most revenue

How much have your monthly expenses grown

Whether a branch is running at a profit or a loss

What VAT you owe and when it’s due

In most Bangladeshi businesses, owners still depend on manual entries or Excel templates.

The result? Delays, missing data, and incomplete balance sheets. With Biznify ERP, all your transactions connect directly to your CoA - meaning reports update automatically.

Here’s how it helps:

1. Instant reporting

Sales, purchases, and expense data sync in real time. No more waiting till month-end to know where you stand.

2. Audit-ready transparency

Every entry has a traceable audit trail. You can show auditors exactly where a number came from no missing receipts.

3. VAT and compliance accuracy

Each account is VAT-mapped based on NBR rules. So when it’s time for tax filing, your reports are already organized.

4. Better decision-making

Because reports are accurate and timely, managers can track spending patterns, set budgets, and plan smarter.

In short, a good Chart of Accounts transforms your financial reports from confusing spreadsheets into useful business insights. Biznify does the heavy lifting behind the scenes, letting you focus on running your business, not fixing accounting errors.

A well-organized Chart of Accounts is more than a list of numbers; it’s the framework that keeps your entire accounting system in order.

When it’s messy, everything from VAT calculation to financial statements gets harder. But when it’s structured and automated, your business runs smoothly.

That’s exactly what Biznify is built for. It helps Bangladeshi businesses, from single outlets to multi-branch companies, set up and manage their accounts in a way that’s simple, VAT-compliant, and audit-ready.

Instead of spending hours cleaning up Excel sheets or chasing missing entries, you get real-time clarity on income, expenses, and cash flow, all from one dashboard.

If you’re setting up your first accounting system or upgrading from manual records, Biznify gives you everything you need to stay organized from day one.

Get a guided product demo tailored to your business needs. No assumptions. No generic walkthroughs. Just real use cases.

.webp)

Just exploring ERP or unsure which modules you need? The Biznify team’s here with straight answers.