“In 2026, the best accounting software in Bangladesh includes Biznify ERP, Tally, QuickBooks, Xero, and Zoho Books. These tools simplify invoicing, tax compliance, payroll, and reporting for businesses of all sizes. Biznify stands out for Bangla support, local training, and cloud-based features designed for the needs of SMEs across the country.”

Implementing the correct accounting architecture optimizes financial workflows, automates statutory reporting, and ensures regulatory compliance, especially in a competitive market like Bangladesh. Whether you run a small startup or a growing enterprise,the right platform automates GL (General Ledger) maintenance, ensures VAT Mushak 6.3 compliance, and generates real-time financial statements—all without the stress of spreadsheets.

In this guide, we’ll explore the best accounting software options available in Bangladesh for 2025. From user-friendly cloud platforms to locally supported solutions, you’ll find tools designed to simplify bookkeeping, improve accuracy, and help your business scale with confidence.

Choosing the right accounting software for your business in Bangladesh is a crucial decision that can significantly impact your financial efficiency and compliance.

Here are the key features to consider to ensure the software meets your business needs and adheres to local regulations:

Ease of Use: Opt for software that is intuitive\ and easy to navigate. This is especially important if you or your team has limited accounting knowledge. A user-friendly interface can reduce the learning curve and increase productivity.

Customization: Ensure the software allows for dashboard and report customization. Customizable widgets and granular reporting filters allow for bespoke data visualization, ensuring quick access to KPIs.

Business Tools Integration: The system must support RESTful API integrations to synchronize data across CRM pipelines, HRM modules, and Payroll processors. Seamless data synchronization eliminates siloed operations, ensuring data integrity across your entire tech stack.

Bank Feeds: Ensure support for automated bank feeds and OCR-based statement imports to streamline the reconciliation process. This feature significantly reduces manual entry and helps maintain accurate financial records.

Growth Accommodation: Choose a cloud-scalable architecture capable of handling high transaction volumes and multi-entity structures without latency. As operations scale, the architecture must support high concurrency and complex database queries without performance degradation. Scalable software grows with you, providing the tools you need at each stage.

Flexible Pricing Plans: Opt for solutions that offer tiered pricing plans. This flexibility allows you to choose a plan that fits your current needs and budget, with the option to upgrade as your business grows.

Cost-Effective Solutions: Balance the software’s cost with the features it offers. Ensure you get value for money by choosing software that provides essential features without unnecessary extras.

Free Trials and Demos: Look for software that offers a free trial or demo period. Testing the software before committing helps you determine if it meets your needs and integrates well with your existing systems.

24/7 Support: Access to SLA-backed technical support is critical for minimizing system downtime during operational critical hours. Ensure the software provider offers round-the-clock support to address any problems that arise.

Educational Materials: Access to tutorials, webinars, and comprehensive documentation is essential. These resources help you and your team get up to speed efficiently, reducing downtime and enhancing productivity.

Bangladeshi Accounting Standards: Verify compliance with Bangladesh Financial Reporting Standards (BFRS) and the VAT Act 2012. This compliance is vital to avoid legal issues and penalties.

Automatic Updates: Cloud platforms push OTA (Over-the-Air) updates to instantly reflect new Finance Act amendments without manual patching. This feature ensures you remain compliant without needing to manually update the software.

Automation: Features like automated invoicing expense tracking, and reconciliation can greatly reduce manual workload. Automation improves accuracy and frees up time for more strategic tasks.

Real-Time Reporting: The software should provide instant insights into your financial status. Real-time reporting enables better decision-making and helps you stay on top of your finances.

Multi-Currency Support: If your business deals with international transactions, multi-currency support is essential. This feature allows you to manage transactions in different currencies without hassle.

By considering these key features, you can select the best accounting software for your business in Bangladesh.

Whether you choose a local favorite like Biznify or an international solution, ensuring the software meets your needs will improve your financial operations and support your business growth.

Using cloud-based accounting software in Bangladesh can revolutionize how you handle your business finances. Here’s why it's a smart move:

Adopting SaaS-based accounting automation streamlines accounts receivable/payable, payroll processing, and general ledger maintenance. Transitioning from manual ledgers to automated workflows mitigates data entry risks and ensures ledger accuracy and free up time for growth-focused activities.

A robust Double-Entry Accounting System ensures accurate Cash Flow Statements and precise Audit Trails. Critical for high-volume environments requiring precise Daily Cash Reconciliation and Accounts Payable (AP) aging analysis.

.Time Efficiency

Automated systems eliminate repetitive work, enabling real-time updates and faster decisions. These digital tools provide the structure needed for SMEs to scale efficiently with minimal administrative burden.

Real-time analytics empower data-driven forecasting and strategic budget allocation. Whether you're checking on cash flow tracking in Bangladesh or preparing for tax season, real-time analytics ensure you're always ready.

Accounting software ensures your financial practices align with Bangladeshi accounting standards and tax regulations. Automatic updates keep you compliant with local tax laws, helping you avoid penalties and legal issues.

Accounting software not only simplifies financial management but also provides valuable insights, saves time, and ensures compliance with local regulations.

Whether you’re a startup or a large enterprise, the right software can help you manage your finances more efficiently and effectively, leading to better business growth and stability.

.png)

These software options offer a range of features that are that are properly ready to meet the diverse accounting needs of businesses in Bangladesh, from small startups to large enterprises.

Each one has its strengths and is designed to improve financial management, fast-track operations, and ensure compliance with local regulations.

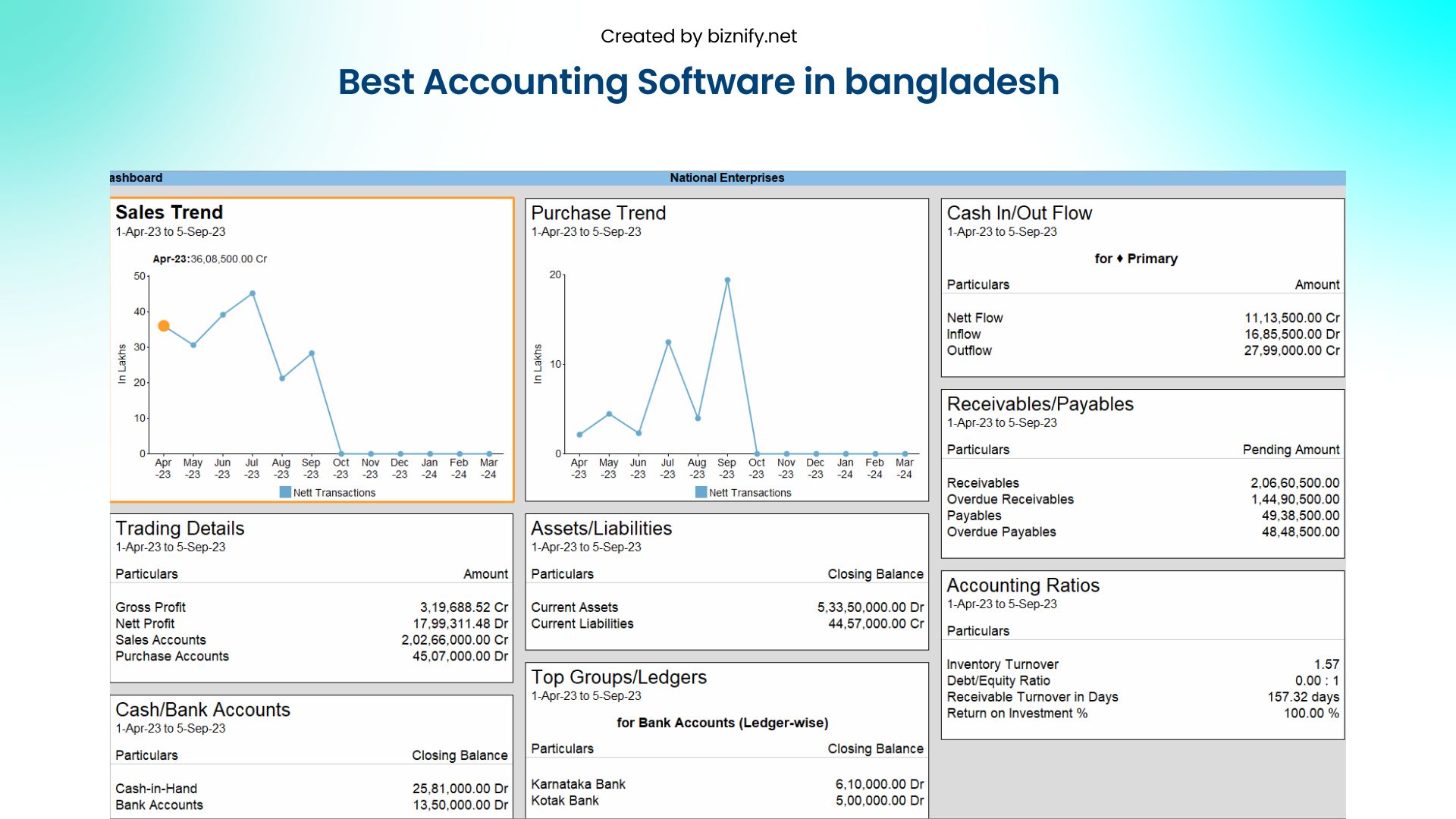

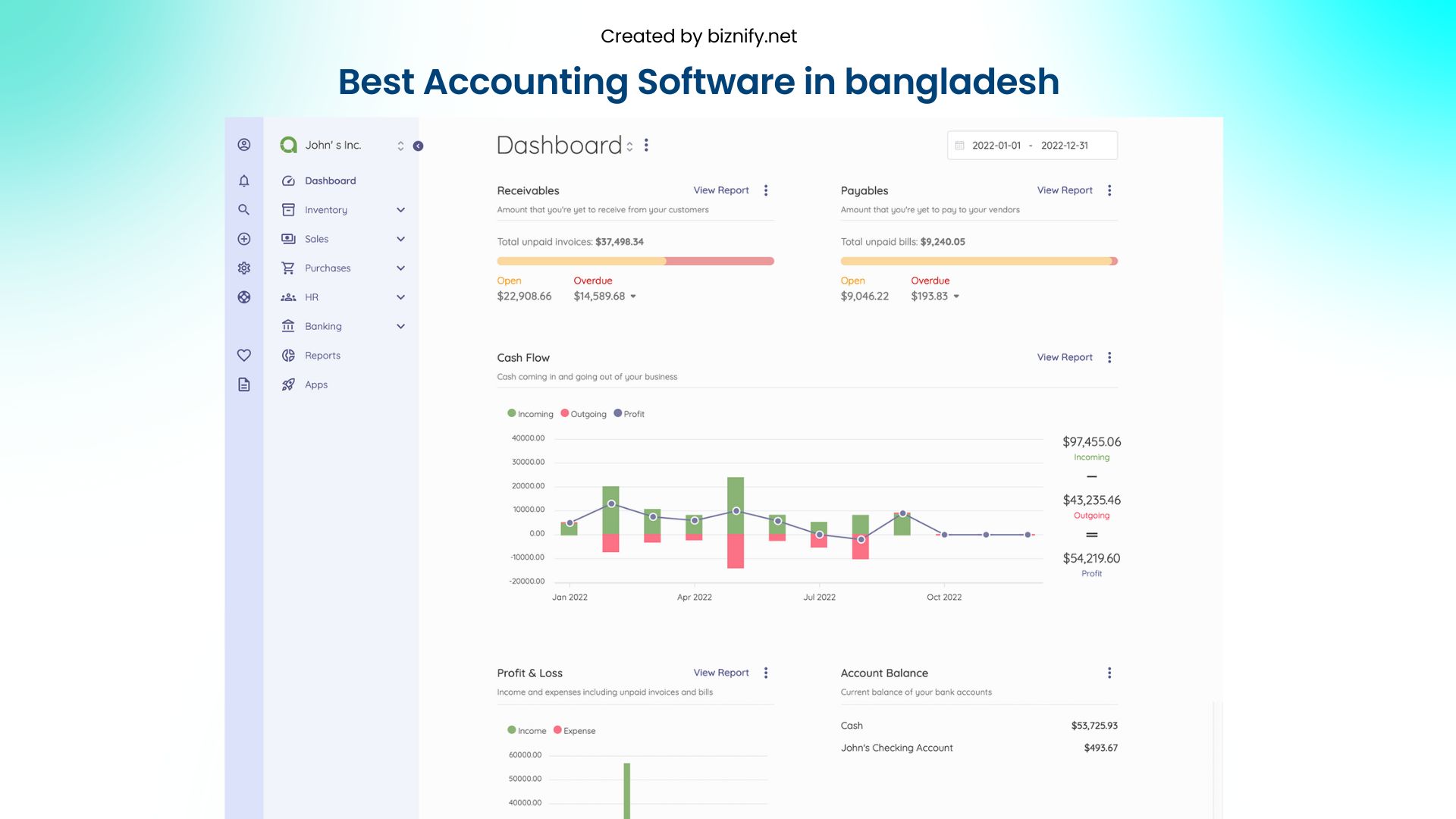

Biznify is a comprehensive Cloud ERP engineered specifically for the Bangladeshi market, integrating Accounting, HRM, and Inventory into a single, unified database. There are some of the features that make Biznify the number one accounting software in Bangladesh.

Why Biznify is Number One?

Biznify is more than just an accounting tool—it’s the best ERP-integrated accounting software for Bangladeshi businesses. It unifies core financial tasks, HR, payroll, and inventory under one system while ensuring your books stay NBR-ready.

Expense Management

Automates accrual-based expense tracking and generates VAT-compliant vouchers tailored to local tax structures.

Real-Time Reporting

Provides dynamic dashboards for monitoring cash flow tracking across departments, ideal for growing SMEs in Bangladesh.

Inventory Tracking & HR

Biznify utilizes a centralized database architecture, ensuring that inventory valuation, payroll entries, and AP/AR ledgers are synchronized in real-time, thanks to its deep ERP integration.

| Pros | Cons |

| User-Friendly | |

| Customizable | |

| Affordable | |

| Top Security |

Biznify Software Pricing

Biznify offers competitive pricing with scalable packages to suit different business sizes and needs:

BASIC: ৳1000/month

STANDARD: ৳1500/month

PREMIUM: ৳2000/month

Software Suitable For Business

Biznify is ideal for a wide range of businesses, including:

Biznify Localization

Biznify fully supports Bangladeshi accounting standards and compliance, so you can focus on running your business without worrying about the fine print.

Tally Prime retains market dominance due to its robust statutory compliance engine and mandatory Audit Trail (Edit Log) features for tax filing and financial reporting.

Why Tally Prime is Popular

Voucher-Based Entry System

Integrated Payroll Processing & Statutory Taxation

Financial Analysis Tools

| Pros | Cons |

| Extensive features | Higher cost for advanced modules |

| Payroll & tax support | Requires training to use well |

| Customizable reports |

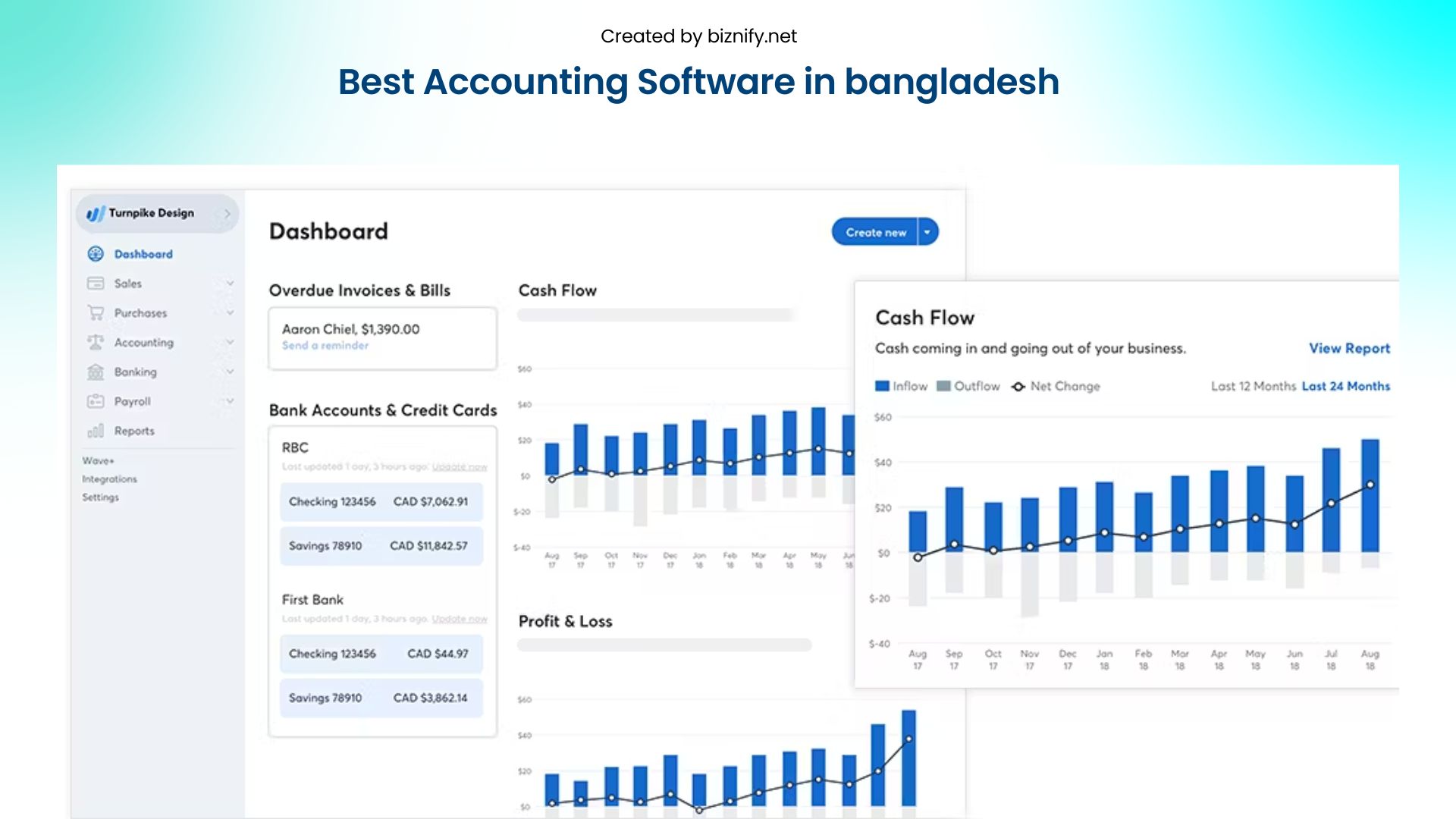

Wave offers a single-entry bookkeeping solution ideal for freelancers requiring basic invoicing and cash-basis reporting and accounting without the big price tag.

Why Wave is Popular

Free Accounting & Invoicing: Zero-cost entry-level bookkeeping module.

Simple Online Payments: Accept credit card payments with ease.

Clear Dashboards: Understand your cash flow at a glance.

| Pros | Cons |

| Free to use | No local Bangladeshi tax support |

| Easy for beginners | Limited advanced features |

| Payment processing fees apply |

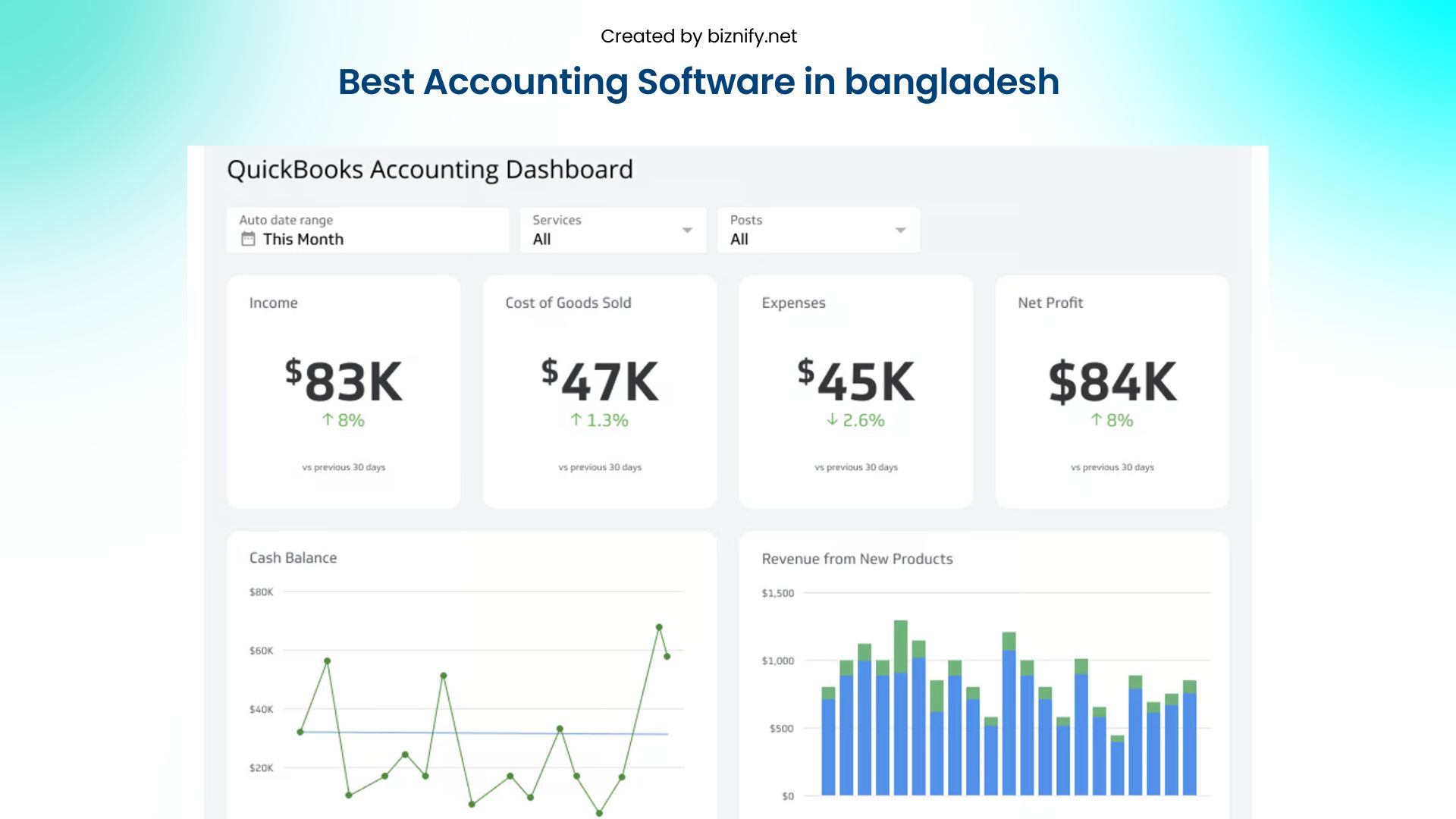

QuickBooks Online leads the market with its SaaS scalability, extensive API ecosystem, and seamless ProAdvisor access, making it a great fit for small and growing businesses.

Why QuickBooks is Popular

All-in-One Accounting: Manage expenses, income, payroll (add-on), and taxes.

Third-Party Integrations: Connect to other business tools easily.

Advanced Reporting: Customizable P&L, Balance Sheets, and Cash Flow forecasts

| Pros | Cons |

| User-friendly interface | Add-ons can increase the total cost |

| Strong integrations | Payroll may require additional costs |

| Great reporting capabilities |

Financfy is a lightweight SaaS solution focused on streamlining expense categorization and multi-currency invoicing for local SMEs in Bangladesh, helping them streamline expenses, invoicing, and multi-currency transactions.

Why Financfy is Popular

Expense Management: Automated expense categorization and digital receipt scanning.

Multi-Currency Support: Handle international payments smoothly.

Invoicing & Billing: Generate and track invoices easily.

| Pros | Cons |

| User-Friendly Interface | Limited Free Plan |

| Mobile accessibility | Premium features cost extra |

| Strong security |

PrismERP is a modular Enterprise Resource Planning system designed for complex manufacturing workflows and supply chain management, including HR, inventory, CRM, and more making it ideal for large, multi-department businesses.

Why PrismERP is Popular

Comprehensive Modules: Covers finance, HR, sales, and inventory.

Real-Time Data: Ensures inter-departmental data consistency via a centralized SQL architecture.

Cloud Storage: Secure access to business data anytime.

| Pros | Cons |

| Platform-independent | Requires stable internet connection |

| Real-time data access | Learning curve for new users |

| Secure cloud storage |

.jpg)

SOROL by Mediasoft is a specialized Retail Management System integrating POS (Point of Sale) directly with financial ledgers. Engineered with a scalable architecture designed specifically to support multi-branch retail operations.

Why Mediasoft (SOROL) is Popular?

SOROL is popular for its comprehensive financial management system and user-friendly interface. It offers real-time monitoring of financial activities and supports multi-entity management, making it suitable for businesses with complex structures.

| Pros | Cons |

| Free to use | No local Bangladeshi tax support |

| Easy for beginners | Limited advanced features |

| Payment processing fees apply |

Akaunting provides a self-hosted, open-source framework, allowing developers to customize the codebase for specific business logic and affordability.

Why Akaunting is Popular

Free & Open Source: No upfront cost; customize as needed.

Cloud-Based: Access from anywhere.

Core Accounting Features: Handle income, expenses, and invoicing.

| Pros | Cons |

| Free & open-source software | Limited official support |

| Easy to set up | Advanced features may require paid apps |

| Cloud accessibility |

HisabNikash offers a localized UX with native Bangla interface support, simplifying bookkeeping for non-English speaking operators. It simplifies core accounting tasks while staying affordable.

Why HisabNikash is Popular

Bangla Language Support: Makes accounting easier for local teams.

Expense & Income Tracking: Stay on top of cash flow.

Invoicing & Billing: Generate and manage bills quickly.

| Pros | Cons |

| User-friendly interface | Limited advanced features |

| Affordable pricing | Less suited for large enterprises |

| Local language support | May require manual VAT adjustments |

Xero is the industry standard for cloud reconciliation, featuring a clean dashboard and automated daily bank feeds, and app ecosystem making it popular with startups and growing businesses worldwide.

Why Xero is Popular

Automated Reconciliation: Matches bank lines to transactions using machine learning algorithms

Third-Party App Marketplace: Integrate with over 1,000 business tools.

Multi-Currency Support: Ideal for businesses with global transactions.

| Pros | Cons |

| Beautiful, easy-to-use interface | Limited local VAT/tax support for Bangladesh |

| Powerful integrations | Some advanced features need add-ons |

| Strong automation & reporting | Monthly pricing in USD may be costly |

“As a CFO with 10 years of experience in Bangladesh, I always advise growing companies to choose accounting software with three key qualities: scalability, strong local support, and customization. Your software should not only meet today’s needs but also scale as your business expands. Reliable local support is critical, especially when you face urgent tax or compliance issues. And finally, customization matters; every business has unique workflows, so having software that can adapt to your specific needs will save time and drive long-term value.”- Mr. Debasis - CFO

Choosing the right accounting software starts with understanding your business’s current and future needs. Early-stage startups typically require streamlined invoicing cycles and burn-rate monitoring, while a growing SME may need advanced features like ERP integration or multi-user access.

Before deciding:

Identify your must-have features: Evaluate requirements for Cloud SaaS deployment, Localization (L10n), and Multi-currency functional logic. Focus on what actually supports your workflows.

Check scalability: Choose software that grows with your business. This ensures you won’t outgrow the platform as your operations expand.

Use free trials smartly: Most tools offer trial periods. Test usability, reporting accuracy, and whether it simplifies tasks like digital bookkeeping or income-expense ledger tracking.

Verify local support: For Bangladeshi businesses, availability of regional support, training, and compliance with local financial practices is essential.

This simplified yet thorough approach helps avoid software fatigue and narrows your list to practical, growth-aligned solutions.

Affordable Solutions: Balance cost with features to ensure value for money. Look for affordable solutions with robust features.

User Reviews and Recommendations: Analyze peer reviews on platforms like Capterra or G2 and request client case studies for similar industries. Real-world feedback provides valuable insights into the software’s performance and reliability.

Customer Support: Ensure the software provider offers robust customer support, including tutorials, webinars, and 24/7 help desks.

Local Compliance: Ensure the software complies with Bangladeshi accounting standards and tax regulations, keeping your financial practices legally sound.

By considering these factors, you can choose accounting software that meets your current needs and supports your business as it grows. The right software will organize financial processes, enhance accuracy, save time, and ensure compliance with local regulations, contributing to your business’s success. If you want to learn more then read this detailed blog about 15 accounting software tips.

Accounting software is an application suite that digitizes financial recording, automating the accounting cycle from journal entry to financial statement generation. It handles bookkeeping, payroll, invoicing, and more, helping businesses keep accurate records and generate financial reports.

For instance, Biznify maintains these processes, making it easier for businesses in Bangladesh to track expenses and income and stay compliant with local regulations.

Accounting software is essential for Bangladeshi businesses for several reasons:

Operational Efficiency: Eliminates manual data entry redundancy and minimizes human calculation errors.

Accuracy: Ensures precise financial records, crucial for making informed decisions.

Statutory Compliance: Automates adherence to National Board of Revenue (NBR) directives and VAT submission requirements.

Cost Savings: Reduces the need for extensive manual bookkeeping.

Scalability: Grows with your business, adding advanced features as needed.

Real-Time Reporting: Provides up-to-date financial data for quick decision-making.

Biznify excels in these areas, offering tailored solutions for local businesses, making financial management a breeze.

Yes, you can use international accounting software in Bangladesh, but consider these factors:

Localization: Ensure it supports Bangladeshi accounting standards.

Currency: It should handle transactions in Bangladeshi Taka (BDT).

Language: Check if it supports Bengali.

Support: Ensure customer support is available in your time zone.

Popular choices like QuickBooks and Xero can be customized, but Biznify is specifically designed to meet the unique needs of Bangladeshi businesses, making it a top choice.

Biznify stands out as the best ERP-integrated accounting software for Bangladeshi businesses. It connects core functions like sales, HR, and inventory with your accounting system, ensuring real-time accuracy and better decision-making.

Mobile accessibility ensures remote oversight of financial KPIs and approval workflows via native iOS/Android apps. Biznify’s mobile features help monitor cash flow, sales, and expenses anytime, anywhere.

Yes, software enforces data validation rules and automates trial balance calculations, effectively eliminating manual errors, reduces data duplication, and improves reporting accuracy.

TCO (Total Cost of Ownership) for accounting platforms in Bangladesh varies based on deployment:

Basic Plans: ৳500 - ৳2000/month, ideal for startups.

Standard Plans: ৳2000 - ৳5000/month, Includes advanced modules such as Inventory Valuation and Multi-Warehouse Management..

Premium Plans: Above ৳5000/month, offering advanced analytics and integrations.

Biznify offers competitive pricing:

BASIC: ৳1000/month

STANDARD: ৳1500/month

PREMIUM: ৳2000/month

This flexibility ensures businesses of all sizes can find a plan that fits their budget and needs.

You gain automated cash flow tracking, reduce errors with digital bookkeeping tools, and stay compliant with VAT regulations. For SMEs, this means more focus on growth and less on repetitive admin tasks.

Biznify offers numerous benefits:

Simplified Processes: Automates invoicing, expense tracking, and payroll, reducing manual work.

Precision and Reliability: Provides consistent and accurate financial data.

Time Efficiency: Frees up time for strategic activities.

Real-Time Insights: Offers up-to-date financial information.

Regulatory Compliance: Ensures adherence to local tax laws and standards.

Scalability: Grows with your business, offering more features as you need them.

With Biznify, businesses in Bangladesh can manage their finances more efficiently, ensuring compliance and making informed decisions that drive growth.

Biznify offers the optimal ROI (Return on Investment), combining enterprise-grade ERP modules with an affordable local subscription model. It’s built for local businesses, so you get essential tools plus VAT compliance without breaking the bank. If you’re looking for free basics, Akaunting and Wave are also popular, but they might miss local compliance features that Biznify covers.

Biznify stands out for its excellent local support in Bangladesh. You get fast help in Bangla, real-time problem-solving, and regular updates that match local tax laws.

Selecting the appropriate financial technology stack is a pivotal strategic decision for optimizing business scalability in Bangladesh. Biznify gives you a clear edge it’s built with local businesses in mind, ensuring smooth compliance, smart automation, and real-time financial insights.

Whether you’re a small startup or a growing enterprise, Biznify helps you stay on top of your finances with easy-to-use tools and reliable local support. Plus, its competitive pricing and customizable features mean you get exactly what you need, without extra hassle.

When choosing accounting software, always think about ease of use, scalability, cost, and how well it fits with your existing systems. Biznify ticks all those boxes, making it a smart pick for businesses aiming for long-term success.

Invest in the best accounting software in Bangladesh with Biznify and elevate your financial management, ensuring your business thrives in a competitive market. You can contact us to check the demo version.

Get a guided product demo tailored to your business needs. No assumptions. No generic walkthroughs. Just real use cases.

.webp)

Just exploring ERP or unsure which modules you need? The Biznify team’s here with straight answers.